An exclusive article for Kaohsiung Times by TUNG Chen-Yuan, Ph.D., Taiwan’s Representative to Singapore

In recent years, China’s semiconductor industry has expanded rapidly under strong policy support, with Semiconductor Manufacturing International Corporation (SMIC) positioned as the country’s flagship for advancing into leading-edge process technologies. However, the latest financial data suggest that even as SMIC has achieved symbolic breakthroughs at advanced process nodes, the gap between it and the world’s leading foundries—in terms of scalable mass production, yield control, and cost structure—has not narrowed. Instead, it has become increasingly visible through the lens of profitability.

7 nm Is Technically Feasible, but Economically Hard to justify

Although SMIC has publicly claimed 7 nm (N+2) process capability, its level of technological maturity and economic efficiency still lags well behind that of TSMC and Samsung. Market estimates indicate that SMIC’s 7 nm yield rate reached close to 40% in 2024. By contrast, industry consensus generally holds that a yield rate of at least 60% is required for advanced processes to be economically viable at scale.

Unable to access extreme ultraviolet (EUV) lithography tools, SMIC has been forced to rely on deep ultraviolet (DUV) lithography combined with multi-patterning techniques. This approach requires circuit patterns that would otherwise be completed in a single exposure to be split into multiple exposures, significantly lengthening production cycles while simultaneously increasing defect risks and per-unit manufacturing costs. More critically, policy-driven requirements to prioritize domestically produced equipment have further constrained process stability and yield control.

As a result, SMIC’s 7 nm production lines continue to face persistently low yields and reliability issues, making it difficult to scale output in a stable manner. From a purely economic perspective, advanced-node manufacturing at SMIC has yet to “add up.”

Technological Gaps Ultimately Show Up on the Income Statement

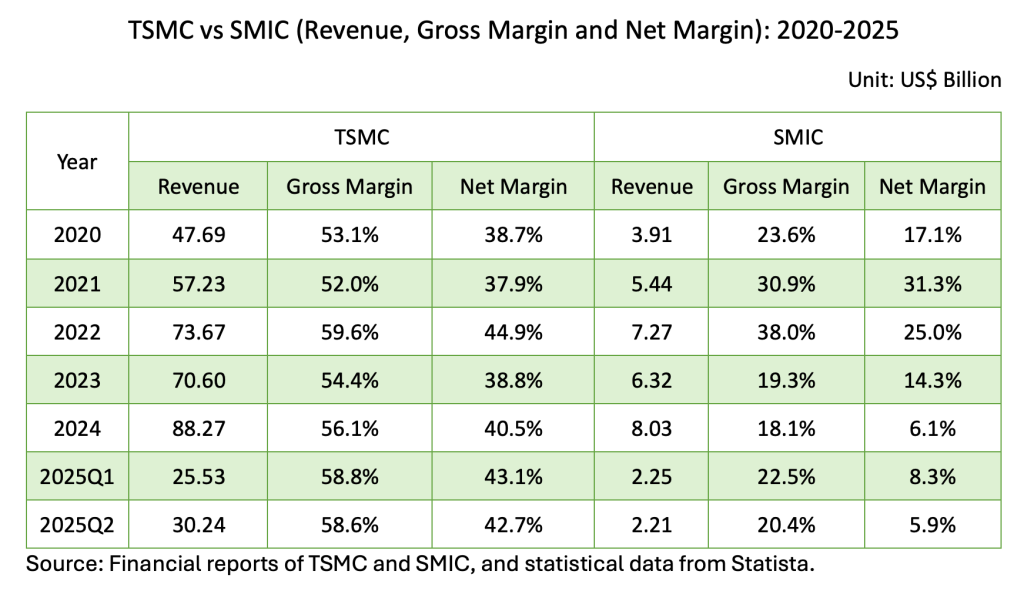

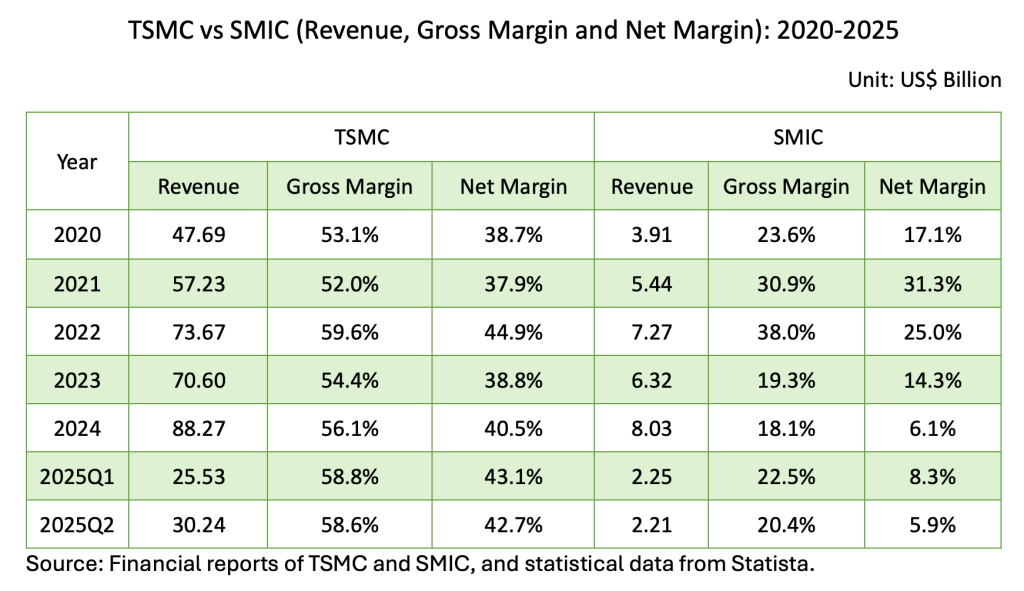

These differences in technology and process capability are not abstract; they are directly reflected in corporate profit structures. According to the latest financial reports, TSMC’s gross margin reached 56.1% in 2024, an increase of 1.7 percentage points from 2023, underscoring its continued efficiency and pricing power in advanced manufacturing.

By contrast, SMIC’s gross margin in 2024 stood at just 18.1%, down from 19.3% the previous year. This decline highlights how rising costs have continued to erode profitability, even as revenue reached record highs.

The disparity is even starker at the net profit level. In 2024, TSMC posted a net margin of 40.5%, while SMIC’s net margin plunged to just 6.1%, far below its 14.3% level in 2023. This sharp deterioration has been widely linked to SMIC’s production of 7 nm chips for Huawei: with low yields and highly complex processes, advanced-node manufacturing has not become a profit engine but rather a cost sink that weighs heavily on earnings.

First Half of 2025: The Gap Is Widening, Not Narrowing

Data from the first half of 2025 show no sign of convergence. TSMC reported gross margins of 58.8% in Q1 and 58.6% in Q2, with net margins consistently above 42%, reflecting its expanding scale advantages in advanced processes and high-end customers.

SMIC, by comparison, saw its gross margin briefly rebound to 22.5% in Q1 2025, only to fall back to 20.4% in Q2. Net margins stood at just 8.3% and 5.9%, respectively. Such performance is more characteristic of a capital-intensive manufacturer struggling under the dual pressures of heavy investment and low process efficiency, rather than a foundry on the cusp of technological catch-up.

By 2025, while TSMC is preparing to mass-produce 2 nm chips for customers such as Apple and Nvidia—pushing the technology frontier forward by roughly three additional nodes—China is still grappling with the economic viability and stability of 7 nm production.

Revenue Growth Cannot Mask Structural Differences

In terms of revenue scale, both companies have continued to grow. TSMC’s revenue increased from about US$47.7 billion in 2020 to approximately US$88.3 billion in 2024. In the first half of 2025 alone, it reached roughly US$55.8 billion, putting the company on track to surpass US$100 billion for the full year. Its gross margin has remained above 50% for an extended period, while net margins have consistently hovered around 40%.

SMIC’s revenue has also expanded rapidly, rising from around US$3.9 billion in 2020 to about US$8 billion in 2024, and reaching roughly US$4.5 billion in the first half of 2025, with full-year revenue likely to exceed US$9 billion. Yet this growth has come at the expense of profitability: gross and net margins fell from 38% and 25% in 2022 to 18.1% and 6.1% in 2024, deteriorating further in the second quarter of 2025.

When a company’s revenue continues to grow but fails to translate into profits, the issue is no longer cyclical—it is structural. Viewed through the comparison between SMIC and TSMC, the core question is no longer simply whether advanced processes can be manufactured, but the far more consequential one: do they actually make money?

About the Author:

Dr. Tung Chen-Yuan is currently Taiwan’s Representative to Singapore. He was Minister of the Overseas Community Affairs Council of the Republic of China (Taiwan) from June 2020 till January 2023. He was Taiwan’s ambassador to Thailand from July 2017 until May 2020, senior advisor at the National Security Council from October 2016 until July 2017, and Spokesman of the Executive Yuan from May to September 2016. Before taking office, Dr Tung was a distinguished professor at the Graduate Institute of Development Studies, National Chengchi University (Taiwan). He received his Ph.D. degree in international affairs from the School of Advanced International Studies (SAIS), Johns Hopkins University. From September 2006 to May 2008, he was vice chairman of the Mainland Affairs Council, Executive Yuan. His areas of expertise include international political economy, China’s economic development, and prediction markets.