An exclusive article for Kaohsiung Times by TUNG Chen-Yuan, Ph.D., Taiwan’s Representative to Singapore

In the third quarter of 2025, the global foundry industry continued to post steady growth. According to the latest research by market intelligence firm TrendForce, the combined revenue of the world’s top ten foundries reached US$ 45.09 billion in the third quarter of 2025, representing a quarter-on-quarter increase of 8.1% and a year-on-year increase of 29.3% compared with the third quarter of 2024. Supported by sustained demand for AI-driven high-performance computing and the rollout of new generations of consumer electronics, overall industry conditions remained on a path of moderate recovery.

Growth momentum during the quarter was driven mainly by two factors. First, continued volume expansion in AI servers and advanced computing platforms kept demand for 7-nanometer and more advanced process nodes at elevated levels. Second, pre-launch inventory build-ups for new smartphone and PC/notebook models boosted demand for chips and peripheral ICs, leading to a simultaneous improvement in capacity utilization for mature process nodes.

TSMC: Global Market Share Exceeds 70%, Contributing More Than 90% of Growth

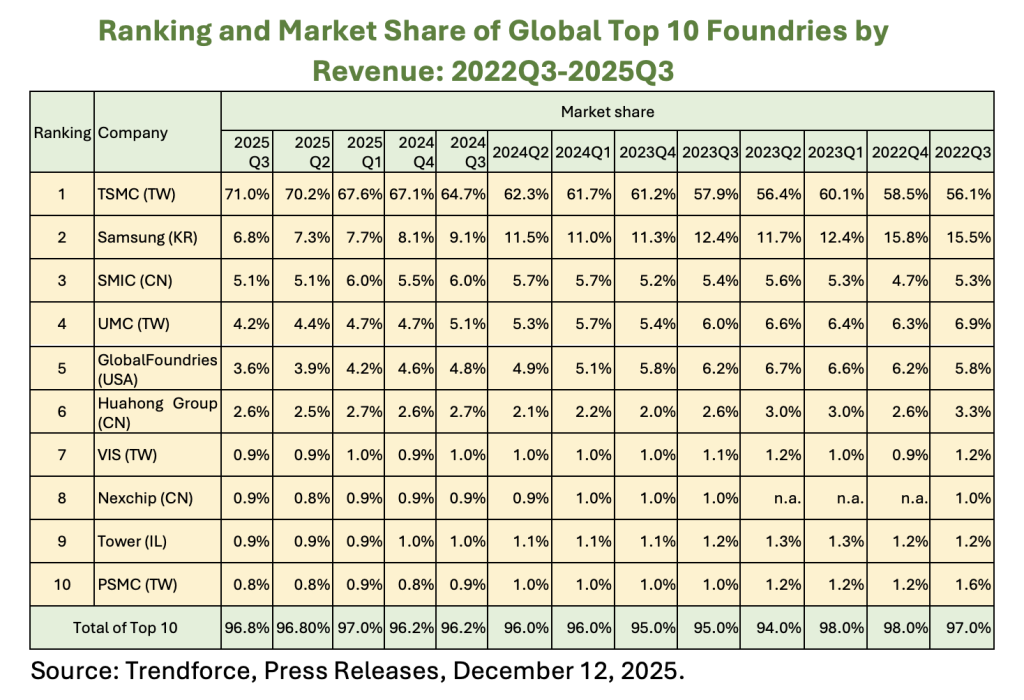

In the third quarter of 2025, TSMC reported quarterly revenue of US$ 33.06 billion, up 9.3% quarter-on-quarter, outperforming the industry average. Its global market share rose to 71.0%, surpassing the 70% threshold for the first time and setting a new historical high.

From the perspective of quarterly contribution, total revenue among the top ten foundries increased by US$ 3.37 billion compared with the previous quarter, of which TSMC accounted for approximately 83.8%, indicating that incremental industry growth during the quarter was largely concentrated in a single firm.

On a year-on-year basis, TSMC’s revenue increased by 40.5%. Out of the approximately US$ 10.1 billion in total annual revenue growth generated by the top ten foundries, TSMC contributed 93.3%, reflecting its structural advantages in advanced process technologies, key customer relationships, and high-value-added product mix.

The Second Tier: Maintaining Scale, Limited Contribution to Overall Growth

Samsung Foundry recorded revenue of US$ 3.18 billion in the third quarter of 2025, representing quarter-on-quarter growth of 0.8%, with a market share of 6.8%. While its capacity utilization improved slightly, its contribution to overall industry growth remained limited at both the quarterly and annual levels.

SMIC posted revenue of US$ 2.38 billion in the third quarter of 2025, up 7.8% quarter-on-quarter, with market share holding at 5.1%. Growth was mainly driven by higher utilization rates and improved average selling prices, but remained heavily concentrated in mature process nodes. Its contribution to overall industry growth was approximately 5% on a quarterly basis and around 2% on an annual basis.

UMC and GlobalFoundries reported third-quarter revenues of US$ 1.98 billion and US$ 1.69 billion, respectively, with quarter-on-quarter growth rates of 3.8% and 0%. Although both benefited from inventory build-ups linked to new consumer electronics launches, they continued to lack strong upward momentum in terms of market share and ASP structure.

Chinese Foundries: Expanding Scale, but Slight Decline in Market Share

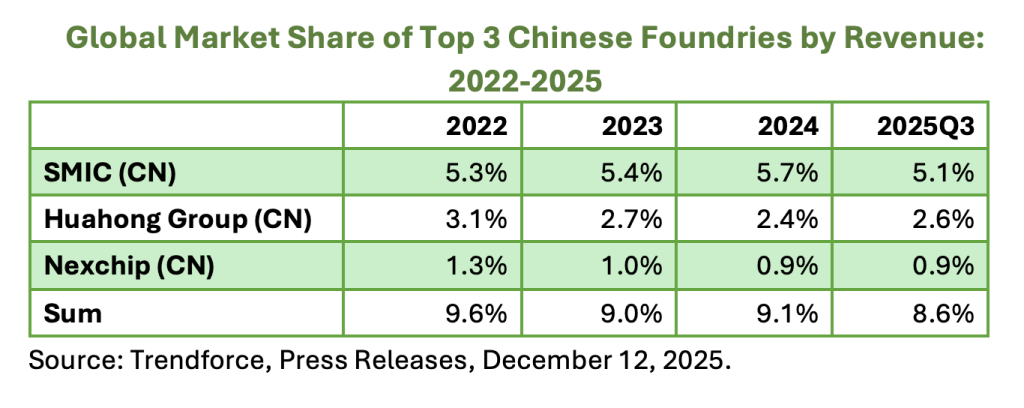

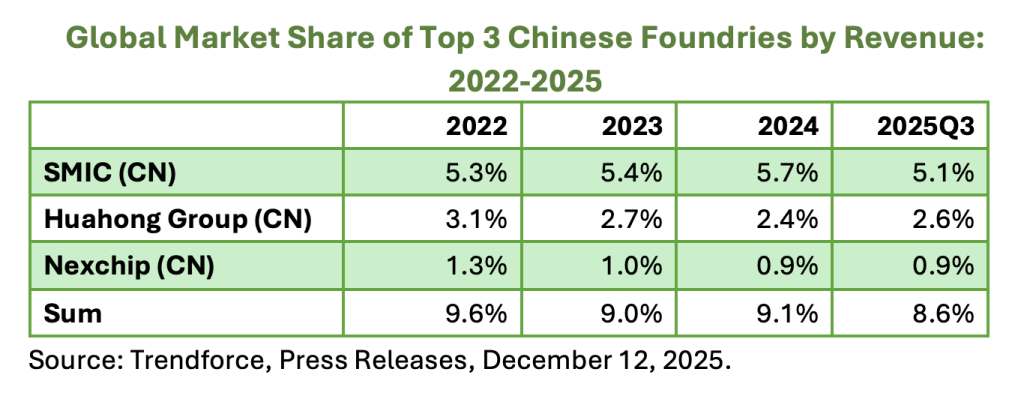

A closer look at the global market share of major Chinese foundries provides further insight into the nature of their growth. According to TrendForce data, the combined global market share of SMIC, HuaHong Group, and Nexchip declined from 9.6% in 2022 to 8.6% in the third quarter of 2025. This suggests that, despite policy support and strong domestic demand, their overall global influence has remained largely stagnant and has even edged down slightly.

Individually, SMIC’s market share increased from 5.3% in 2022 to a peak of 5.7% in 2024, before retreating to 5.1% in the third quarter of 2025. HuaHong Group’s share declined from 3.1% to 2.6%, while Nexchip’s fell from 1.3% to 0.9%, where it has since stabilized. A common feature among these firms is their heavy reliance on mature process nodes, with constrained average selling prices limiting the ability of market share to rise in tandem with capacity expansion.

Overall, growth in China’s foundry sector has primarily reflected global demand expansion and internal substitution, rather than a meaningful displacement of existing international market share.

Long-Term Market Share Trends: Rising Concentration

From the third quarter of 2022 to the third quarter of 2025, TSMC’s market share rose from 56.1% to 71.0%, an increase of nearly 15 percentage points over three years. Over the same period, Samsung’s market share declined from above 15% to the 6%–7% range.

The combined market share of the top ten foundries has consistently remained in the 96%–97% range, indicating that the industry was already highly concentrated. However, structural changes over the past three years have been characterized by a continued expansion of the market leader’s share, further consolidating the industry around TSMC as a single dominant core.

Overall, the global foundry industry in the third quarter of 2025 exhibited a structural profile of moderate growth and high concentration. TSMC’s advantages in advanced process technology, customer structure, and capital investment discipline translated into growth contributions—both quarterly and annual—that significantly exceeded those of its peers.

About the Author:

Dr. Tung Chen-Yuan is currently Taiwan’s Representative to Singapore. He was Minister of the Overseas Community Affairs Council of the Republic of China (Taiwan) from June 2020 till January 2023. He was Taiwan’s ambassador to Thailand from July 2017 until May 2020, senior advisor at the National Security Council from October 2016 until July 2017, and Spokesman of the Executive Yuan from May to September 2016. Before taking office, Dr Tung was a distinguished professor at the Graduate Institute of Development Studies, National Chengchi University (Taiwan). He received his Ph.D. degree in international affairs from the School of Advanced International Studies (SAIS), Johns Hopkins University. From September 2006 to May 2008, he was vice chairman of the Mainland Affairs Council, Executive Yuan. His areas of expertise include international political economy, China’s economic development, and prediction markets.