Special for Kaohsiung Times.

By TUNG Chen-Yuan, Ph.D., Taiwan’s Representative to Singapore.

As the third quarter of 2025 draws to a close, the global semiconductor foundry industry is clearly moving toward a higher degree of concentration. A market once characterized by numerous competitors and a diverse landscape is now steadily consolidating around a few enterprises capable of breakthrough manufacturing processes. Although the demand for advanced computing continues to drive up the scale of the global market, the latest financial and industry data reveal that the gap between leading enterprises is actually widening, thereby making Taiwan’s strategic position in the global supply chain even more prominent.

Widening Financial Performance and Competitive Gaps

Statistics from TrendForce show that TSMC delivered another dazzling performance in the third quarter of 2025. Consolidated quarterly revenue reached US$33.1 billion, a substantial increase of 40.8% year-on-year, setting a new historical record. Benefiting from undiminished demand for High-Performance Computing (HPC) and smartphones, advanced processes below 7 nanometers contributed as much as 74% of revenue. TSMC’s gross margin of 59.5% and net profit margin of 45.6% demonstrate that it maintains a global leading standard in process efficiency, yield management, and supply chain collaboration.

In comparison, although Samsung announced an operating profit of US$8.37 billion and demonstrated progress in 2nm GAA process technology—showing its ambition to rebuild its market position—its overall market share has yet to recover to past highs.

Intel continues to march toward organizational restructuring. Its third-quarter revenue grew to US$13.7 billion. Simultaneously, through the sale of equity in Altera and securing US$5.7 billion in funding from the U.S. government, it is accelerating the transformation of its manufacturing capabilities.

While SMIC saw revenue growth, restricted by its inability to acquire EUV lithography equipment, its net profit margin stood at only 13.2%. The gap with TSMC is stark, limiting its expansion in the high-end logic chip market.

The Decisive Point in the Race for Advanced Processes

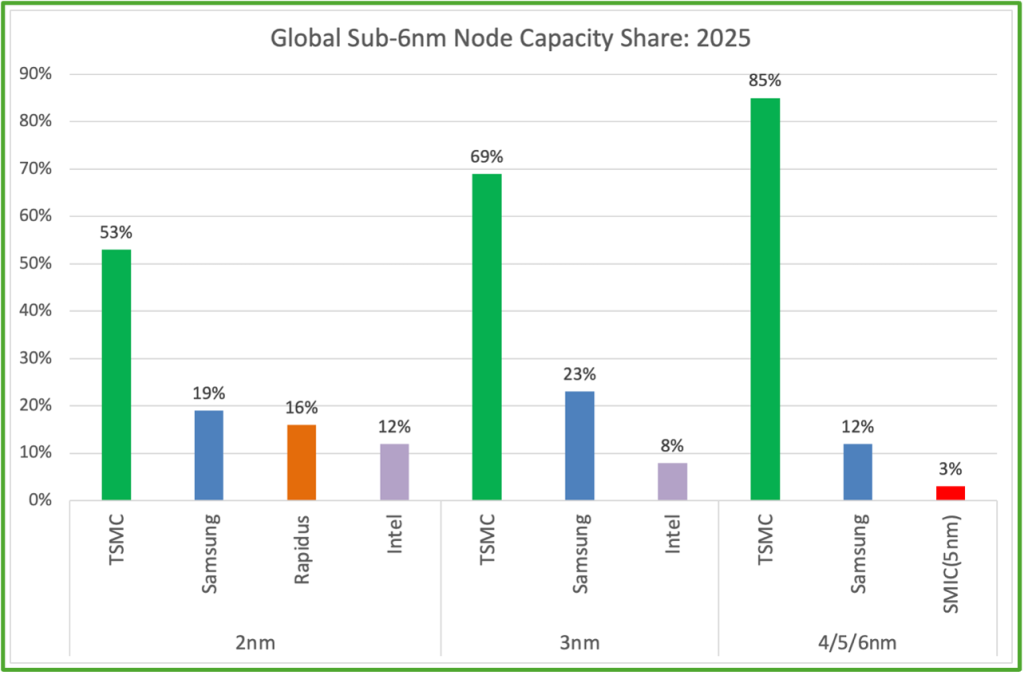

These disparities are even more pronounced in the layout of advanced processes. According to data from the Industrial Technology Research Institute (ITRI), in the 2nm technology driving artificial intelligence computing, TSMC controls 53% of global capacity, far leading Samsung’s 19% and Intel’s 12%. Regarding the more commercially valuable 3nm process, TSMC’s market share stands as high as 69%, with Samsung at 23% and Intel at 8%.

Even in the 4nm to 6nm nodes, which have entered large-scale mass production and mature competition, TSMC still holds approximately 85% of the market share. The shares of Samsung and SMIC lag significantly behind, highlighting Taiwan’s profound strength in lithography equipment, supply chain integration, and talent systems.

The Solid Foundation of Taiwan’s Semiconductor Ecosystem

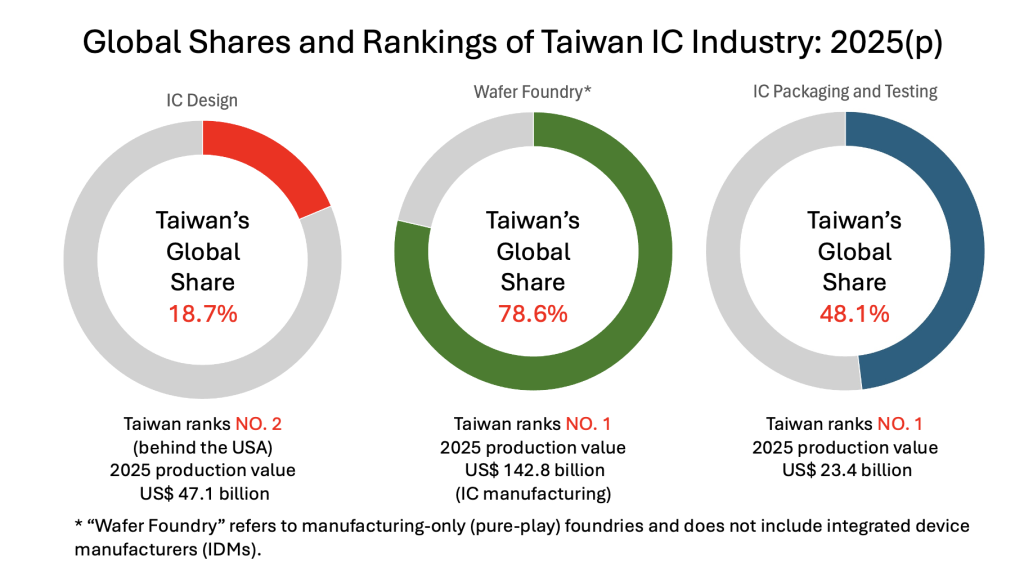

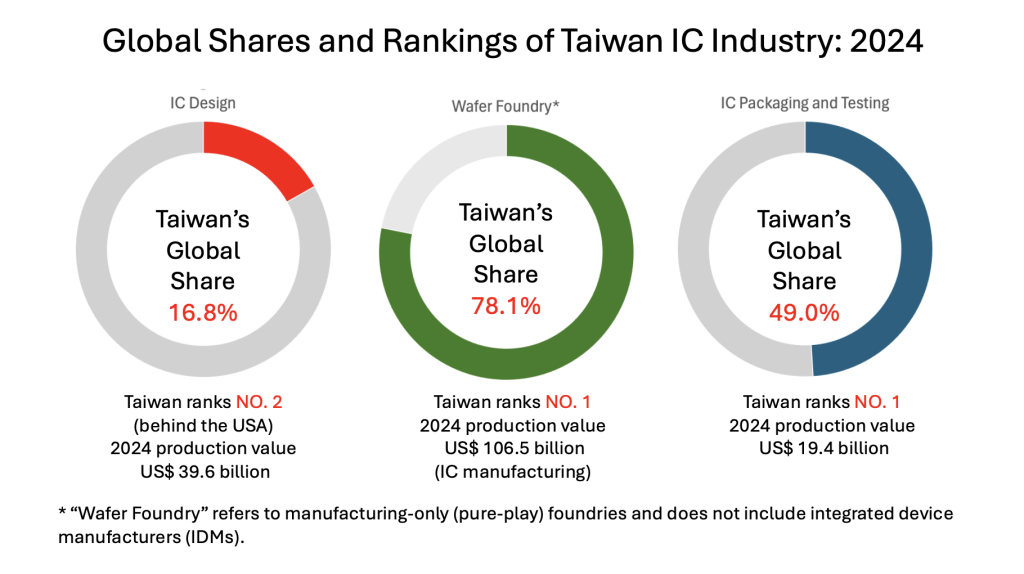

Supporting TSMC’s global leadership is not only the company’s own technological depth but also Taiwan’s complete and resilient industrial ecosystem. According to ITRI statistics, Taiwan demonstrated strong momentum in 2024: IC design production value reached US$ 39.6 billion, with a market share of 16.8%, second only to the United States; IC manufacturing production value reached US$ 106.5 billion, with foundry market share as high as 78.1%, firmly ranking first globally; packaging and testing production value reached US$ 19.4 billion, accounting for 49% of the global total, maintaining a substantial lead.

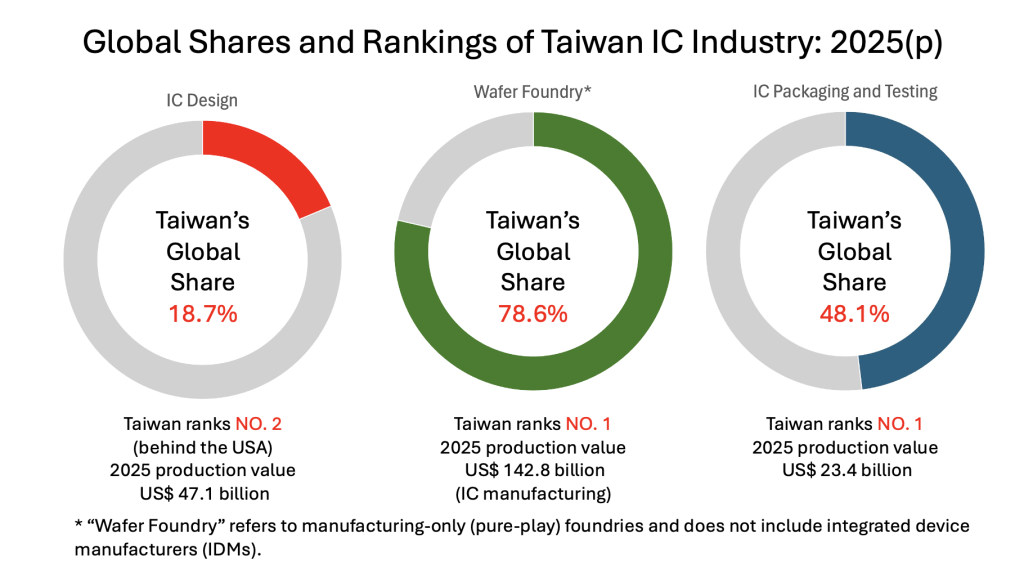

Looking ahead to 2025, ITRI predicts that Taiwan’s IC design production value will grow to US$ 47.1 billion, increasing its market share to 18.7%, still second only to the U.S.; IC manufacturing production value is expected to expand to US$ 142.8 billion, with the foundry market share rising to 78.6%; packaging and testing production value is estimated to reach US$ 23.4 billion, with a market share maintained at a world-leading 48.1%. These trends indicate that Taiwan’s role in the global semiconductor supply chain will further deepen, and the integration capabilities and innovative energy of its industrial clusters will continue to strengthen.

Global Coopetition and Layout Amidst Geopolitics

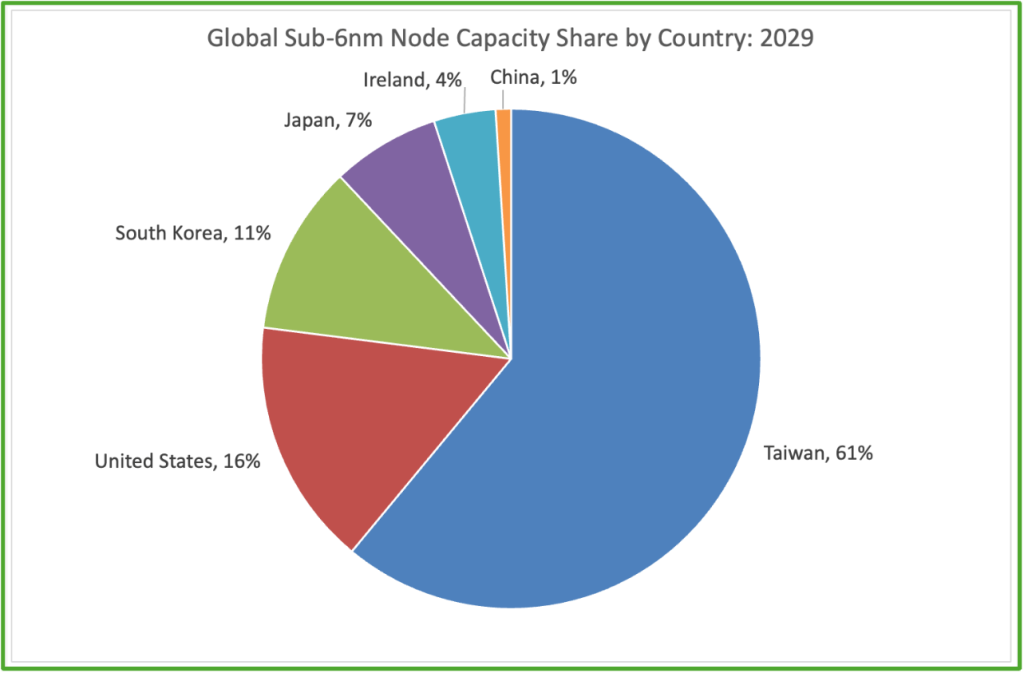

Although global geopolitics are constantly shifting and various countries are introducing policies to strengthen semiconductor supply chains—such as the U.S. “CHIPS and Science Act” and tariff policies—the core of advanced manufacturing remains firmly located in Taiwan. According to existing factory construction plans and capacity planning, ITRI’s medium-to-long-term forecast indicates that by 2029, 61% of global 2nm to 6nm capacity will be distributed in Taiwan, with the U.S. accounting for about 16%, South Korea 11%, Japan 7%, and China only 1%.

While local capacity established by the U.S. through Intel’s new Arizona plants and TSMC’s US$40 billion investment helps strengthen supply chain resilience, its primary function is to supplement rather than replace Taiwan’s core status. Facing Samsung’s aggressive layout in Texas and Intel’s bet on 18A process technology, the immense industrial clusters and density of engineering talent established by Taiwan in Hsinchu, Tainan, and Kaohsiung remain of irreplaceable importance and constitute Taiwan’s fundamental advantage in global competition.

The global semiconductor foundry industry is rapidly concentrating toward technology leaders, and market competition is shifting from broad contestation to deep integration. For TSMC, continuing to deepen technology, steadily expanding capacity, and maintaining excellence in execution are key to consolidating its global leadership position. With Taiwan maintaining global market shares of nearly 80% in wafer foundry and 50% in packaging and testing, coupled with the robust growth of the IC design industry, the overall ecosystem demonstrates powerful resilience and continues to reinforce Taiwan’s core role in the global technology chain.

About the Author:

Dr. Tung Chen-Yuan is currently Taiwan’s Representative to Singapore. He was Minister of the Overseas Community Affairs Council of the Republic of China (Taiwan) from June 2020 till January 2023. He was Taiwan’s ambassador to Thailand from July 2017 until May 2020, senior advisor at the National Security Council from October 2016 until July 2017, and Spokesman of the Executive Yuan from May to September 2016. Prior to taking office, Dr Tung was a distinguished professor at the Graduate Institute of Development Studies, National Chengchi University (Taiwan). He received his Ph.D. degree in international affairs from the School of Advanced International Studies (SAIS), Johns Hopkins University. From September 2006 to May 2008, he was vice chairman of the Mainland Affairs Council, Executive Yuan. His areas of expertise include international political economy, China’s economic development, and prediction markets.