By TUNG Chen-Yuan, PhD, Taiwan’s Representative to Singapore

In recent years, Taiwan’s outward investment has undergone a sustained structural shift in regional allocation, reflecting firms’ strategic adjustments in response to changes in the global trade and economic environment. According to the latest statistics, Taiwan’s investment in Singapore reached US$ 2.29 billion in 2025, accounting for 5.7% of total outward investment. This marked the second time in nearly three decades that Taiwan’s investment in Singapore surpassed that in China. Notably, investment in Singapore has exceeded investment in China by more than 50% for two consecutive years, indicating that this trend is gradually becoming entrenched.

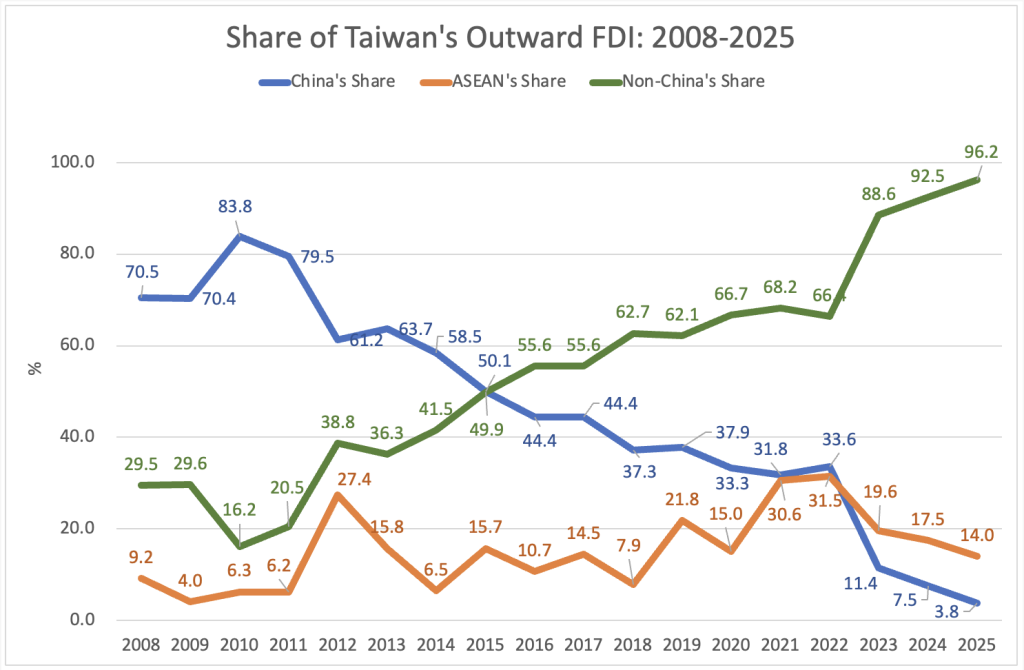

Historically, Taiwan’s investment in China peaked in 2010, accounting for 83.8% of total outward investment that year, reflecting the close industrial division of labor and high degree of market integration across the Taiwan Strait at the time. However, as China underwent structural economic adjustments, operating costs rose, and awareness of geopolitical and supply-chain risks increased, the share of Taiwan’s investment in China began to decline year by year after 2010. By 2025, this share had fallen to 3.8%, a new historical low.

Meanwhile, Taiwan’s investment in non-China destinations has continued to rise. In 2016, investment in non-China regions surpassed investment in China for the first time, marking a key turning point. By 2022, the share had further increased to 66.4%. In 2025, investment in non-China regions accounted for as much as 96.2% of Taiwan’s total outward investment—around 12 times the level invested in China—demonstrating a highly diversified and multi-pronged outward investment pattern.

Within this transformation, ASEAN countries have gradually become major investment destinations for Taiwanese firms. In 2021, Taiwan’s investment in ASEAN amounted to US$ 5.64 billion, representing 30.6% of total outward investment. Although the investment value dipped slightly to US$ 4.73 billion in 2022, the share rose to a record high of 31.5%. In 2024, investment in ASEAN climbed to US$ 8.49 billion, reaching an all-time high. While it eased back to US$ 5.57 billion in 2025, it remained at a solid level, underscoring firms’ continued long-term confidence in the ASEAN market.

Among ASEAN countries, Singapore plays a pivotal role. Prior to the COVID-19 pandemic, Taiwan’s annual investment in Singapore was mostly below US$ 1 billion. In the post-pandemic period, as firms reassessed regional operations and capital allocation, Singapore’s role as a regional financial and high-tech hub became increasingly prominent, and Taiwan’s investment in Singapore grew rapidly. Between 2021 and 2024, investment amounted to US$ 3.71 billion, US$ 3.36 billion, US$ 2.44 billion, and US$ 5.81 billion, respectively, with a year-on-year growth rate of as high as 138% in 2024. Although investment declined to US$ 2.29 billion in 2025, it remained well above pre-pandemic levels.

From a structural perspective, Taiwan’s investment in Singapore accounted for 5.7% of total outward investment in 2025 and 41% of its investment in ASEAN. On a cumulative basis from 2021 to 2025, Taiwan’s total investment in Singapore reached US$ 17.6 billion, representing 59.3% of its total investment in ASEAN and 11.8% of overall outward investment. This highlights Singapore’s role as a key gateway for Taiwanese capital entering ASEAN and global markets.

In terms of industrial distribution, Taiwan’s investment in Singapore is highly concentrated in high-value-added sectors. In 2025, investment in electronic components manufacturing reached US$ 1.67 billion, accounting for 72.9% of Taiwan’s investment in Singapore that year, indicating deepening cooperation at the core of the semiconductor and high-tech supply chains. Financial and insurance services and wholesale and retail trade accounted for 9.2% and 7.1% respectively. Together, the top three sectors represented 89.2% of total investment, reflecting a clear and strategically oriented industrial structure.

Overall, the regional and industrial reallocation of Taiwan’s outward investment represents a rational response by firms to global economic changes, supply-chain restructuring, and the need for market diversification. Leveraging its stable institutional environment and highly internationalized platform—while maintaining strong complementarity with Taiwan’s industrial structure—Singapore has emerged as a key investment partner of long-term strategic significance for Taiwanese enterprises. Looking ahead, deepening industrial collaboration and promoting two-way investment in high-tech sectors will be central to the continued development of Taiwan–Singapore economic and trade relations.