By TUNG Chen-Yuan, PhD, Taiwan’s Representative to Singapore

In 2025, against the backdrop of slowing global economic growth, continued monetary tightening among major economies, and persistent geopolitical uncertainty, Singapore’s external trade structure underwent a noteworthy shift. According to the Economic Survey Report just released by Singapore’s Ministry of Trade and Industry, Taiwan became Singapore’s largest merchandise trading partner in 2025, surpassing China and Malaysia. Notably, just one year earlier in 2024, Taiwan ranked only fourth. This sharp rise does not reflect a short-term anomaly, but rather the combined outcome of supply chain realignments and structural changes in trade patterns.

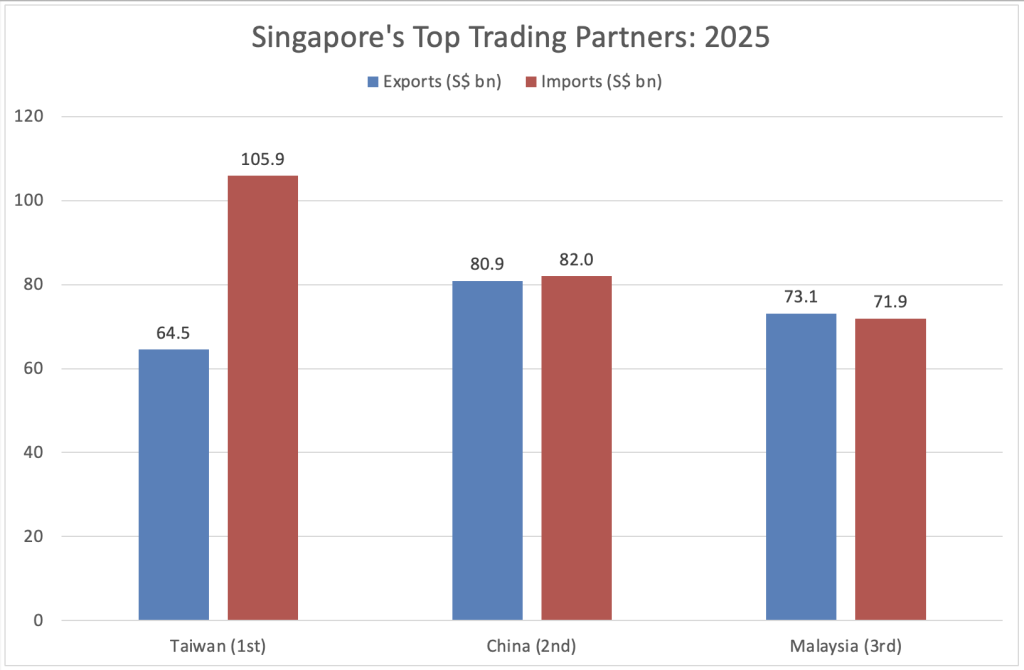

From an aggregate perspective, total bilateral merchandise trade between Singapore and Taiwan reached approximately S$170.4 billion in 2025, exceeding Singapore’s trade with China (S$162.9 billion) and Malaysia (S$145.0 billion) during the same period. A closer look reveals that this was not a one-sided expansion, but the result of growth in both exports and imports. In 2025, Singapore’s exports to Taiwan amounted to around S$64.5 billion, while imports from Taiwan reached S$105.9 billion, making Taiwan Singapore’s largest single source of imports.

This shift is also closely linked to the structural drivers of Singapore’s overall economic growth in 2025. That year, Singapore’s economy performed relatively steadily, with a significant portion of its momentum coming from external trade—particularly the expansion of imports and exports of electronics and high-technology products. Amid diverging demand across major markets, the trade sector emerged as a key pillar supporting economic growth, with Taiwan playing a crucial role as one of Singapore’s most important trading partners.

From a market perspective, Singapore’s export performance to major economies in 2025 showed clear divergence. Non-oil domestic exports to China and the United States both declined, reflecting adjustments in market demand and a softening in certain industry cycles. In contrast, non-oil domestic exports to Taiwan grew markedly during the same period, surging by 37.4%—the strongest performance among Singapore’s major trading partners. This indicates that Singapore’s export momentum was not in broad-based decline, but rather increasingly concentrated in specific markets and industries.

The core driver behind the rapid growth in Taiwan–Singapore trade is closely tied to recent investments related to artificial intelligence and high-performance computing. As AI applications continue to expand, demand for data centers and high-performance computing has risen in tandem, pushing global demand for advanced semiconductors steadily higher. Against this backdrop, bilateral trade has become highly concentrated in the semiconductor sector. In 2025, approximately 80% of Taiwan’s exports to Singapore consisted of semiconductors and related products, while about 60% of Singapore’s exports to Taiwan were semiconductor-related equipment and intermediate goods.

This trade structure is reinforced by the substantial investments made by Taiwanese firms in Singapore in recent years. United Microelectronics Corporation (UMC) announced in 2022 an investment of approximately US$ 5 billion to expand its third-phase semiconductor fabrication facility in Singapore, with mass production expected to begin in 2027. Meanwhile, in 2024, Taiwan’s Vanguard International Semiconductor partnered with NXP Semiconductors of the Netherlands in a joint investment of about US$ 7.8 billion to build a 12-inch wafer fabrication plant in Singapore, further strengthening the island’s capabilities in mature-node and analog semiconductor manufacturing.

As Taiwan Semiconductor Manufacturing Company (TSMC) gradually transfers its mature-node operations to Vanguard International Semiconductor, Vanguard’s Singapore facilities are set to play an increasingly important role in the global supply system for mature semiconductor processes. These investments are not isolated developments; rather, they align closely with shifts in bilateral trade structure, reinforcing the Taiwan–Singapore semiconductor partnership from the manufacturing side.

Within this division of labor, Singapore supplies high-value-added semiconductor equipment, precision components, and testing-related intermediate inputs, while Taiwan integrates these inputs into advanced process technologies and chip manufacturing systems to meet global market demand. Such trade flows are not centered on final consumer goods, but are deeply embedded in production processes, characterized by clear technological thresholds and strong industrial interdependence—factors that contribute to the relative stability of bilateral trade relations.

Beyond direct exports, Singapore’s role as a re-export hub in its trade with Taiwan also deserves attention. In 2025, re-exports accounted for 61.5% of Singapore’s total merchandise exports, remaining a core component of its external trade. Within this structure, Taiwan emerged as one of the fastest-growing markets for Singapore’s non-oil re-export trade. Official data show that Singapore’s non-oil re-exports to Taiwan grew by 146% year-on-year in 2025, primarily involving computers and related components.

Although official statistics do not disclose the absolute value of non-oil re-exports to Taiwan separately, an examination of the overall structure indicates that re-export trade has become an important pillar of Singapore’s exports to Taiwan. Together with direct exports, it has supported the continued expansion of bilateral trade. This underscores that Taiwan–Singapore economic ties are built not only on equipment and intermediate goods supply, but are also deeply embedded in regional logistics networks and supply chain specialization.

On the other hand, Singapore’s imports from Taiwan significantly exceed its exports, reflecting the depth of bilateral supply chain integration. In 2025, growth in Singapore’s overall non-oil imports was driven mainly by integrated circuits and telecommunications equipment, with Taiwan serving as one of the key sources. Some of these imported products undergo further processing, testing, or re-export in Singapore, giving bilateral trade the characteristics of a cross-border production network.

From a policy and strategic standpoint, Taiwan’s emergence as Singapore’s largest trading partner also reflects tangible progress in Singapore’s efforts to diversify its markets. As demand in some traditional markets slowed, trade with technology-oriented economies such as Taiwan provided important support for Singapore’s external trade and overall economic growth. For Taiwan, this development likewise signals a transition in bilateral economic relations toward a model characterized by deeper industrial specialization and supply chain cooperation.

Looking ahead, geopolitical dynamics and changes in trade policy may continue to influence global supply chain configurations. Nonetheless, the data for 2025 demonstrate that Taiwan–Singapore economic and trade relations in semiconductors and related industries are grounded in genuine demand and complementary structures. How both sides can further deepen semiconductor collaboration, strengthen supply chain resilience, and extend cooperation into the AI industry will be a central issue shaping the future of their bilateral economic relationship.

About the Author:

Dr. Tung Chen-Yuan is currently Taiwan’s Representative to Singapore. He was Minister of the Overseas Community Affairs Council of the Republic of China (Taiwan) from June 2020 till January 2023. He was Taiwan’s ambassador to Thailand from July 2017 until May 2020, senior advisor at the National Security Council from October 2016 until July 2017, and Spokesman of the Executive Yuan from May to September 2016. Before taking office, Dr Tung was a distinguished professor at the Graduate Institute of Development Studies, National Chengchi University (Taiwan). He received his Ph.D. degree in international affairs from the School of Advanced International Studies (SAIS), Johns Hopkins University. From September 2006 to May 2008, he was vice chairman of the Mainland Affairs Council, Executive Yuan. His areas of expertise include international political economy, China’s economic development, and prediction markets.