An exclusive article for the Kaohsiung Times by TUNG Chen-Yuan, Ph.D.

Taiwan’s Representative to Singapore.

In the prevailing narrative of semiconductor supply-chain diversification, public attention has long focused on Taiwan Semiconductor Manufacturing Company’s (TSMC) large-scale expansion into the United States, Japan, and Germany. Yet a close examination of capacity data and technology roadmaps leads to a clear conclusion: even as TSMC’s international footprint reaches unprecedented scale, the center of gravity of global chip manufacturing remains—and for the foreseeable future will continue to remain—firmly anchored in Taiwan.

As of the end of 2025, more than 90 percent of TSMC’s total manufacturing capacity is still concentrated in Taiwan, with an even higher share at the most advanced technology nodes. The company is deliberately building a “diversified yet asymmetrical” global manufacturing network to enhance overall resilience—overseas fabs, however, function as strategic extensions rather than replacements for Taiwan’s core production base.

The Asymmetry of Expansion

This asymmetry is most evident in TSMC’s much-publicized U.S. investment. The company has raised its commitment to the Arizona “Gigafab” cluster to US$165 billion, with plans to build three fabrication plants. The first facility (Fab 21, Phase 1) entered volume production in early 2025 using the 4-nanometer process, reportedly achieving yields about four percentage points higher than comparable lines in Taiwan.

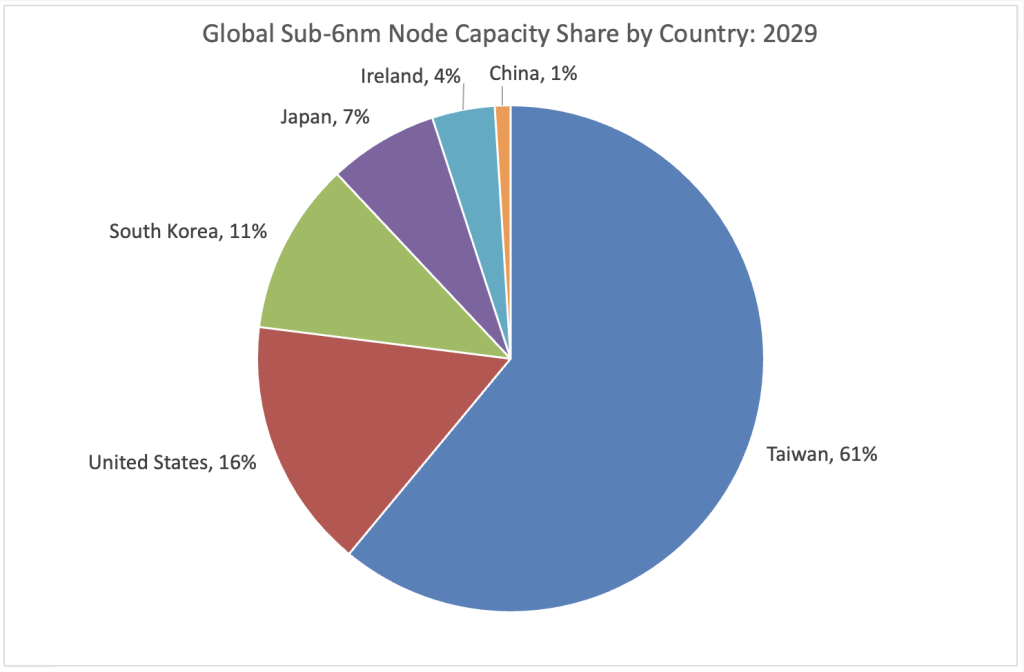

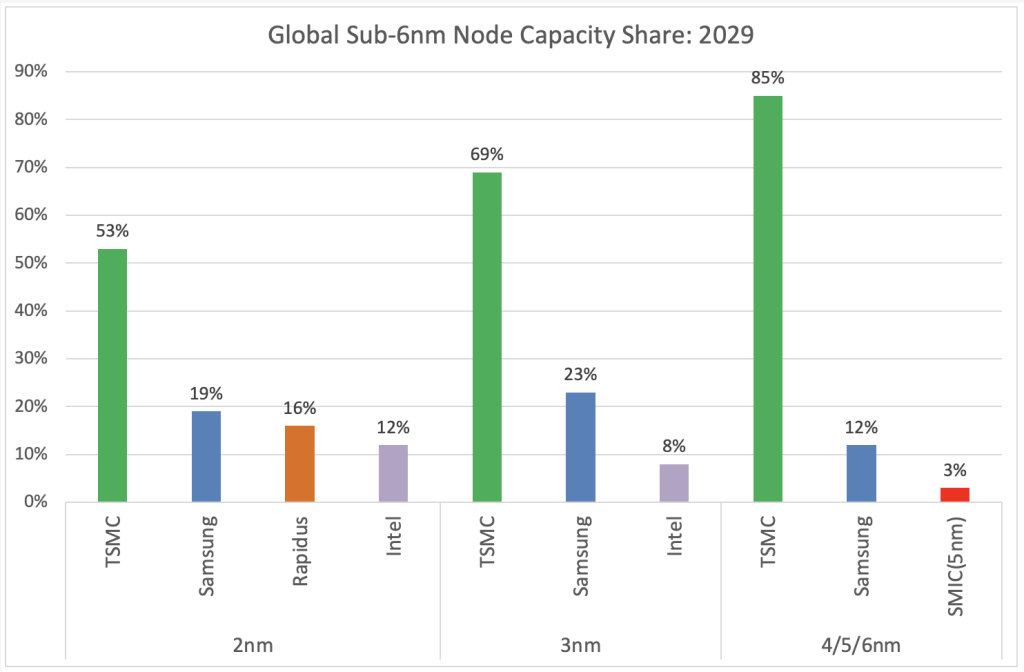

Even so, viewed in the context of TSMC’s overall output, the U.S. contribution remains limited. Even after the Arizona complex reaches full operation, the global distribution of advanced manufacturing capacity will continue to tilt decisively toward Taiwan. Projections by the Industrial Technology Research Institute (ITRI) indicate that by 2029, Taiwan will still control 61 percent of global sub-6nm capacity, compared with 16 percent for the United States, 11 percent for South Korea, and just 1 percent for China.

The Technological Frontier Remains in Taiwan

At the cutting edge of technology, this Taiwan-centric structure is even more pronounced. Taiwan continues to serve as the primary base for TSMC’s most advanced logic research and development, as well as volume production. While overseas fabs deploy strategically selected nodes—such as 4nm and 3nm in the United States, and mature processes in Japan and Germany—the true battle with the limits of physics is still being fought in Taiwan. TSMC is aggressively scaling up mass production of its 2-nanometer (N2) process in Kaohsiung and Hsinchu, while simultaneously preparing for the next-generation 1.4-nanometer (A14) node. In the 2-nanometer segment alone, TSMC is expected to command about 53 percent of global capacity by 2029, with the overwhelming majority located in Taiwan’s gigafabs. The implication is clear: the global footprint may expand, but the technological anchor driving the Angstrom era remains immovable in Taiwan.

A Hub-and-Spoke Global Network

TSMC is evolving into a truly global enterprise, but it is not hollowing out its foundations. Each overseas site has a clearly defined regional role: the Arizona fabs strengthen supply-chain complementarities with major U.S. customers; the Kumamoto facility in Japan integrates deeply with local image-sensor and automotive ecosystems; and the Dresden fab supports Europe’s industrial and manufacturing base.

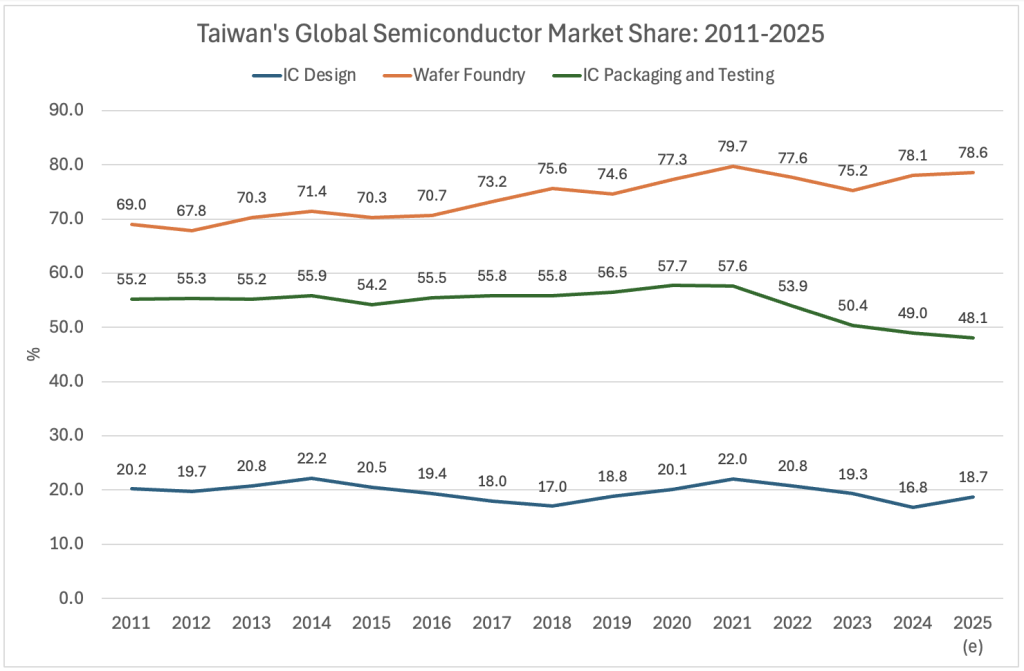

Yet all of these “spokes” ultimately revolve around a single “hub”—TSMC itself. As demand for artificial intelligence and high-performance computing surges, the global semiconductor industry is projected to approach a trillion-dollar valuation by 2027. Far from being diluted, Taiwan’s role has become even more critical. In 2025, Taiwan is estimated to hold more than 78.6 percent of the global foundry market share, making it an indispensable lifeline of the modern digital economy.

Ultimately, the data leaves little room for ambiguity. TSMC’s global expansion is real and consequential—but it represents expansion, not replacement. With more than 90 percent of capacity and the roadmap to 1.4-nanometer technology firmly rooted at home, Taiwan is not merely where TSMC is located. It remains the beating heart of the global semiconductor ecosystem—stable, irreplaceable, and very much alive.

About the Author:

Dr. Tung Chen-Yuan is currently Taiwan’s Representative to Singapore. He was Minister of the Overseas Community Affairs Council of the Republic of China (Taiwan) from June 2020 till January 2023. He was Taiwan’s ambassador to Thailand from July 2017 until May 2020, senior advisor at the National Security Council from October 2016 until July 2017, and Spokesman of the Executive Yuan from May to September 2016. Before taking office, Dr Tung was a distinguished professor at the Graduate Institute of Development Studies, National Chengchi University (Taiwan). He received his Ph.D. degree in international affairs from the School of Advanced International Studies (SAIS), Johns Hopkins University. From September 2006 to May 2008, he was vice chairman of the Mainland Affairs Council, Executive Yuan. His areas of expertise include international political economy, China’s economic development, and prediction markets.